Shifting Trends: Lab-Grown Diamonds Challenge Traditional Markets

The concept of luxury investment is evolving, witnessing a transformation that redefines the allure of traditional gems like diamonds while showcasing the soaring appeal of digital currencies, particularly Bitcoin.

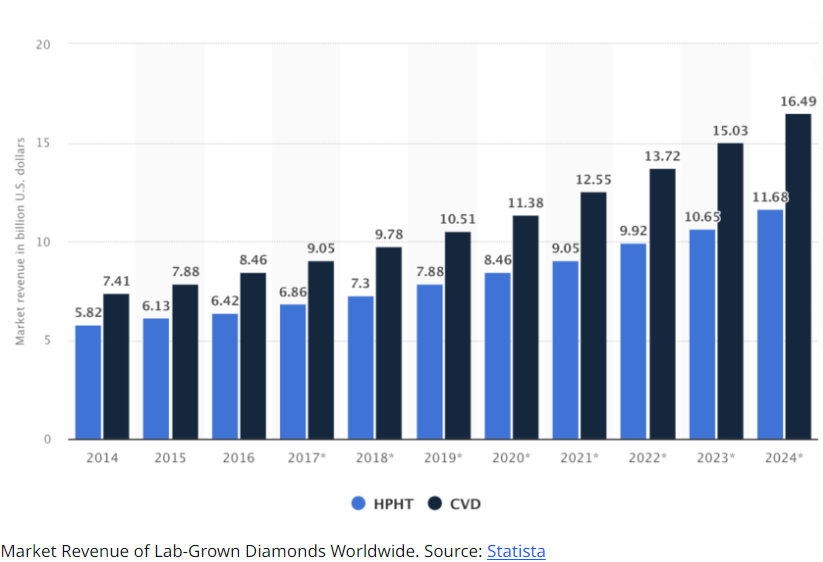

The age-old dominance of natural diamonds, largely shaped by entities like DeBeers, is encountering a seismic shift with the growing preference for lab-grown diamonds. These alternatives emulate the aesthetic and characteristics of natural diamonds but at a fraction of the price. Their ethical and environmental advantages have drawn consumers towards these options, and retailers like Macy’s are reflecting this shift.

In this changing landscape, lab-grown diamonds, previously regarded as “synthetic,” now stand recognized by esteemed organizations like the Gemological Institute of America and the Federal Trade Commission, legitimizing their place as luxury goods. Sales figures soared to $12 billion in 2022, signalling a rapid surge in global acceptance.

The Diamond Decline: Rebranding Lab-Grown Gems

Mary Carmen Gasco-Buisson, Chief Marketing Officer at Pandora, notes, “For most people, a diamond is a diamond.” This mindset shift, accompanied by the Gemological Institute of America’s validation, has significantly altered the market landscape, pointing towards a broader decline in the traditional diamond market, influenced by global inflation and evolving consumer choices.

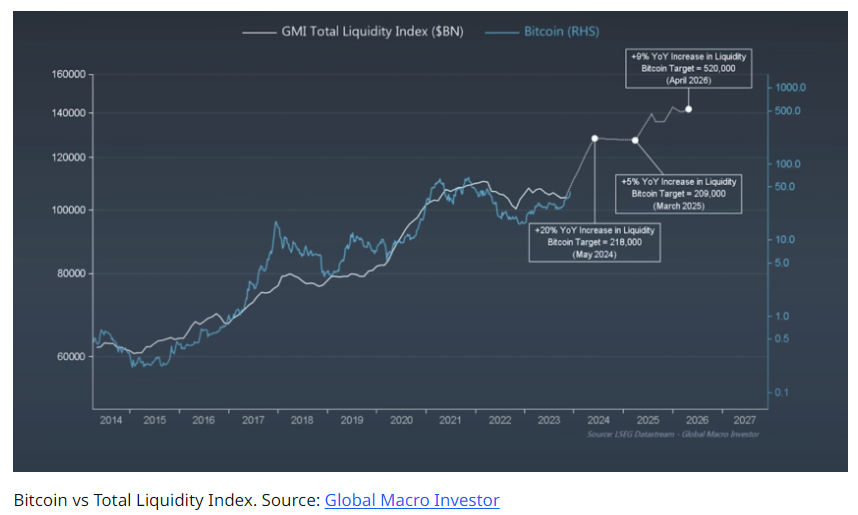

Meanwhile, the investment horizon is witnessing a notable shift towards Bitcoin. The cryptocurrency’s limited supply and decentralized nature have appealed to both individual and institutional investors, offering a hedge against market volatility and inflation. The anticipation surrounding the potential approval of a Bitcoin spot ETF has heightened interest, with experts like Samson Mow and Raoul Pal predicting significant price surges.

The Future of Wealth: Bitcoin’s Ascension and Diamond’s Descent

The juxtaposition of Bitcoin’s ascent and the diamond market’s decline encapsulates a broader societal transformation in values and investment perspectives. Bitcoin, representing dynamic growth potential, contrasts with diamonds’ static luxury appeal. This shift signifies not merely a choice between assets but a paradigmatic shift in what defines value and wealth in today’s world.

Disclaimer: This article provides informative insights. Readers are advised to verify information independently and seek professional advice before making financial decisions.